Mortgage Broker In Scarborough Fundamentals Explained

Wiki Article

Some Ideas on Scarborough Mortgage Broker You Should Know

Table of ContentsThe 25-Second Trick For Mortgage Broker ScarboroughSome Known Details About Mortgage Broker Scarborough The Facts About Mortgage Broker RevealedThe Only Guide to Mortgage Broker3 Easy Facts About Mortgage Broker In Scarborough DescribedOur Scarborough Mortgage Broker IdeasThe Best Guide To Mortgage Broker ScarboroughMortgage Broker Scarborough Can Be Fun For Anyone

You're a little anxious when you initially show up at the mortgage broker's workplace. You require a home car loan However what you actually want is the residence."What do I do currently?" you ask. This initial meeting is essentially an 'info gathering' goal. The home loan broker's job is to recognize what you're attempting to achieve, exercise whether you prepare to enter from time to time match a lender to that. However before chatting about loan providers, they require to gather all the info from you that a financial institution will certainly require.

The Buzz on Mortgage Broker Near Me

A significant modification to the industry happening this year is that Home mortgage Brokers will certainly have to adhere to "Benefits Task" which implies that lawfully they have to place the customer first. Surprisingly, the banks don't have to follow this brand-new regulation which will profit those customers making use of a Home mortgage Broker much more.It's a mortgage broker's work to assist obtain you prepared. It could be that your financial savings aren't rather yet where they should be, or it could be that your revenue is a bit suspicious or you've been freelance and the financial institutions need even more time to evaluate your situation. If you're not yet prepared, a home loan broker exists to furnish you with the knowledge and also guidance on just how to improve your placement for a lending.

Fascination About Scarborough Mortgage Broker

Home loan brokers are writers. Their work is to paint you in the light that provides you the biggest opportunity of being accepted for a financing. The lender has authorized your finance.Your house is yours. Written in partnership with Madeleine Mc, Donald.

See This Report on Mortgage Broker In Scarborough

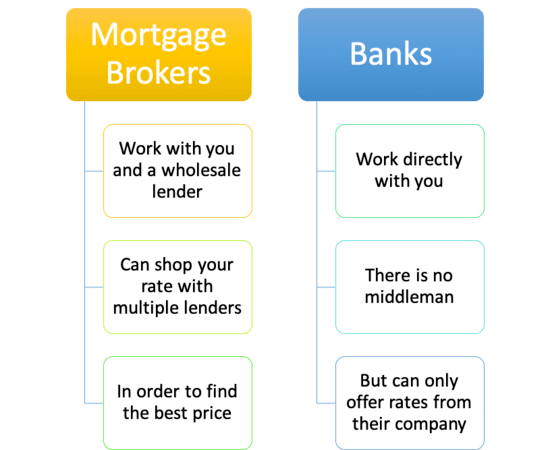

They do this by contrasting home mortgage products provided by a selection of lenders. A mortgage broker works as the quarterback for your funding, passing the round between you, the customer, and also the loan provider. To be clear, mortgage brokers do far more than aid you get an easy home mortgage on your house.

When you most likely to the bank, the financial institution can only supply you the services and products it has available. A financial institution isn't most likely to tell you to decrease the road to its rival that provides a mortgage product better matched to your needs. Unlike a financial institution, a mortgage broker often has partnerships with (frequently some lenders that don't directly deal with the public), making his opportunities that better of finding a loan provider with the best home loan for you.

What Does Mortgage Broker Scarborough Mean?

If you've currently made an offer on a property and also it's been approved, your broker will submit your application as a real-time offer. Once the broker has a mortgage commitment back from the lending institution, description he'll look at any type of problems that need to be fulfilled (an evaluation, evidence of income, evidence of down repayment, etc). mortgage broker.

The smart Trick of Scarborough Mortgage Broker That Nobody is Talking About

When all the lender conditions have actually been met, your broker should make sure lawful directions are sent to your legal representative. Your broker should proceed to sign in on you throughout the process to make certain everything goes smoothly. This, in a nutshell, is just how a mortgage application works. Why utilize a home mortgage broker You might be asking yourself why you ought to utilize a home loan broker.Your broker should be well-versed in the mortgage products of all these lending institutions. This suggests you're more probable to discover the very best home mortgage item that matches your demands. visit site If you're a specific with broken credit report or you're getting a home that's in much less than outstanding condition, this is where a broker can be worth their weight in gold.

Little Known Questions About Mortgage Broker.

/mortgage-broker-3b0953175a7e4d90b99e937b79e0cd14.jpg)

Make certain to ask your broker the number of lending institutions he handles, as some brokers have accessibility to even more loan providers than others and might do a higher quantity of company than others, which indicates you'll likely get a better price. This was a review of working Full Report with a home loan broker (mortgage broker near me).

The Single Strategy To Use For Mortgage Broker Scarborough

85%Promoted Price (p. a.)2. 21%Contrast Price (p. a.) Base criteria of: a $400,000 finance amount, variable, dealt with, principal and also passion (P&I) residence fundings with an LVR (loan-to-value) proportion of at least 80%. Nevertheless, the 'Compare Home Loans' table permits calculations to made on variables as selected and input by the user.The alternative to making use of a home mortgage broker is for people to do it themselves, which is often described as going 'straight'. A 2018 ASIC study of consumers who had obtained a car loan in the previous year reported that 56% went direct with a lender while 44% went with a home loan broker.

Report this wiki page